Emotional Distress in Injury Claims When dealing with someone else’s negligence, financial compensation for physical…

How are personal injury settlements paid out?

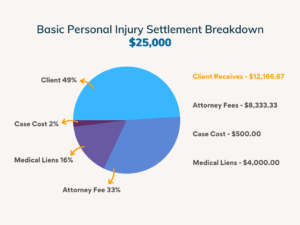

Who Pays the Bills? Detailed overview of how your personal injury settlements are distributed.

A common misconception regarding settlement agreements with insurance companies is that the process is over when a settlement agreement is established. However, there are more steps after the negotiation that you should know to prepare for your own personal injury claim.

Once your attorney and the insurance company come to an agreement on your claim, then the next step is to wait for the settlement check — and distribute the funds accordingly to pay off your debts. Below is a diagram of how a typical settlement is divided and distributed.

When a claim settles, then you are done with the claim. Therefore, you cannot reopen the claim, even if you notice flare ups to your personal injuries that were sudden or insidiously. Insurance companies will ensure your claim is officially closed by requesting you sign a release of all claims.

The money paid on your bodily injury claim will be shown on your settlement draft, essentially a check. The settlement amounts will not be divided into categories. The sums for pain and suffering, medical bills, and/or wages will not be broken down. Any remaining balances pertaining to the accident claim are compensated from those proceeds.

When Will You Receive Your Settlement Check?

Insurances companies are confined to deadlines and time constraints mandated by state law. Therefore, they must cut the check within the time frame. But insurer’s accountants vary in time on when they issue the check.

Once you have been notified that your check was sent out, then you should be receiving the funds within two (2) weeks from this date. In the situation where you do not receive the check by the two-week period, the insurance company may be guilty of bad faith for delaying your payment. Be sure to keep your attorney informed if this does happen.

Costs That Reduce Your Personal Injury Settlement Amount

You will see commercials of personal injury attorneys ensuring high settlements. The truth is that there are costs and fees that decrease the settlement proceeds. These costs are compensated before the final settlement check is distributed to the claimant.

Medical liens enforce reimbursable payments for medical treatment, paid by insurance companies so they can be compensated when the personal injury claim settles. This takes away from your settlement, as many patients do not have the money to pay their providers upfront for treatment. So, instead of paying as you receive medical care, you reimburse the payments made on your behalf by the insurance companies. There are different types of liens, such as – mechanics liens, health insurance liens, and employer liens that may be associated with your settlement. With the help of an attorney, you may be able to negotiate the value of these liens, as well.

Additional bills accrue when a personal injury settlement process is prolonged to weeks, or even months. The patient may need further care, which as a result, increases the bills for the treatment. Since these bills were not included when deciding how much to ask in a personal injury settlement, they must be paid out of any non-monetary damage calculation and assessment.

Attorney’s fees compensate your lawyer and their paralegals for the work they have done for you. When you hire your attorney, you are required to pay a certain percentage of your settlement to compensate your attorney. You will sign a contract at the time of hire that will explain in detail the fee policy. Your attorney may also be able to request that the defendant in the suit be held accountable for attorney’s fees, as well.

Most personal injury lawyers work on a contingency fee basis. This means you do not pay anything until you are paid. When a settlement amount is agreed upon, you will then pay your lawyer a portion of your entire settlement funds for compensation.

Additional Expenses are the other fees and costs that often accrue when filing a personal injury case. These may consist of postages, court filing fees, and/or certified copy fees. These are a few of the associated regular costs that are considered in your personal injury claim.

Lump-Sum vs. Structured Settlement

Lump sum payout implies you receive your entire settlement in one payment. A structured settlement pays you in increments over time. How you receive your settlement is entirely up to you. If you are someone who does not want to spend their settlement at once, a structured settlement may be more suitable for you.

Settlement Taxes

Don’t forget your taxes! Receiving a settlement may require you to pay your taxes on a portion of your award, in the tax year that you received the funds. Although, injury settlements are less often taxed as income by the federal government, punitive damages may still be liable to taxation.

Reopening a Claim Once It Has Settled

The short response? Majority of the time, you are not permitted to reopen your claim or engage in further communication with insurances companies to negotiate a different settlement amount. Therefore, you must examine the settlement offer carefully to ensure the funds sufficiently addresses your injuries and losses before accepting any settlement.

How to Calculate Personal Injury Settlement Demands

You are at the best advantage if you hire a lawyer early in the settlement process for your personal injury claim. They can regulate communication with the defendant’s attorney or their paralegals to protect your rights and to ensure you are requesting the full amount of compensation you are due.

For the first step in calculating your settlement request, you will want to include all monetary losses in your claim. This consists of money you have already paid or may still owe. Then, you will derive nonmonetary damages from the monetary losses you previously calculated. Let us say your treatment continued longer than you expected, a reasonable estimate can be included so your settlement also calculates ongoing medical care, while staying within Washington’s three (3)-year statute-of-limitations timeframe.